您现在的位置是:【微信950216】太平洋在线公司电话 > 时尚

Michigan family takes home seizure case to Supreme Court over $1,600 tax

【微信950216】太平洋在线公司电话2026-02-02 22:49:51【时尚】6人已围观

简介Facebook TwitterThreads FlipboardCommentsPrintEmailAdd Fox News on GoogleMichi

- Threads

- Comments

- Add Fox News on Google

Michigan family who lost home over tax bill takes property rights case to Supreme Court

The Pung family says Isabella County wrongfully foreclosed on a nearly $200,000 home over a disputed tax bill that ballooned to $2,242 — and kept their hard-earned equity. Their case will be argued at the U.S. Supreme Court on Feb. 25.

NEWYou can now listen to Fox News articles!A Michigan family says a minor tax dispute cost them their home, and now they are taking their property-rights fight all the way to the U.S. Supreme Court.

The estate of Scott Pung argues Isabella County, Mich., officials committed unconstitutional "home equity theft" by seizing a nearly $200,000 house to satisfy a debt that grew from a $1,600 tax dispute to $2,242 with interest and penalties.

"Somehow we lost the house. I still don't quite understand it," Tia Pung told Fox News Digital. "The taxes had been paid. Never missed a payment. Never late. And when that $1,600 wasn't paid, they filed for foreclosure."

"It's simply mind-boggling," she added.

The Pung family is suing Isabella County, Michigan officials, alleging home equity theft in a case going before the U.S. Supreme Court in February. (Pacific Legal Foundation)

NEW JERSEY FAMILY WINS BATTLE TO SAVE 175-YEAR-OLD FARM FROM EMINENT DOMAIN

The legal saga began more than a decade ago when Tia and Marc Pung inherited a 3,000-square-foot home in suburban Michigan that had belonged to Marc's father, Scott. Despite a history of timely tax payments, a local county assessor retroactively revoked the family's Principal Residence Exemption (PRE) — a tax credit for primary homeowners — because Scott's estate did not resubmit an affidavit declaring the home as a primary residence.

Though a tax tribunal later ruled the family was entitled to the exemption for earlier years, the county assessor again denied the exemption for the 2012 tax year, the filings say.

Michael Pung, representing his brother’s estate, attempted to pay the bill he believed was due, according to the family's petition to the Supreme Court. However, he was told the amount was insufficient because of the revoked exemption and additional, previously unbilled penalties. The county then moved to foreclose on the home to recover the unpaid tax.

"Marc and I were remodeling the house, tore down walls... thinking that there's not a chance in hell that they can actually take this house for this reason," Tia Pung said. "Well, naively, ignorantly, we were wrong."

The Pacific Legal Foundation alleges Michigan county officials seized the Pung family home over a tax bill that was never owed. (Pacific Legal Foundation)

BUSINESS OWNERS TAKE ON CITY THEY SAY IS PLAYING 'MUSICAL CHAIRS' WITH PROPERTY IN EMINENT DOMAIN CASE

In 2019, Isabella County auctioned the home for $76,008 despite an assessed value of $194,400. An investor bought the property and flipped it about 18 months later for $195,000.

The county kept the remainder of the auction proceeds after paying the roughly $2,000 debt. While a lower court eventually forced the county to return the surplus proceeds from the home's auction, the family argues they are still being deprived of more than $118,000 in earned equity, based on the home's assessed value.

"Destroying over $118,000 in equity to collect a $2,242 disputed tax bill is a punitive forfeiture," the court petition reads.

"Instead of placing a lien on their property or finding other ways to collect, they foreclosed and auctioned it away," Larry Salzman, an attorney with the Pacific Legal Foundation (PLF), who is representing the Pung estate in court, told Fox News Digital. "All the equity that the family had built up in that home was destroyed."

INSIDE TRUMP’S FIRST-YEAR POWER PLAYS AND THE COURT FIGHTS TESTING THEM

The Supreme Court is seen on Capitol Hill in Washington, Dec. 17, 2024. (AP Photo/J. Scott Applewhite, File)

In its response to the court petition, Isabella County argues that it did not concede the home's fair market value was $194,400 and "regardless, assessed values do not accurately reflect fair market value."

The Pung estate brings constitutional questions about the Fifth Amendment and the Eighth Amendment before the court.

"The dispute now going to the Supreme Court of the United States is when the government takes more than they're owed, they seize property, they take more than they're owed. How much do they have to return to the family they took it from?" Salzman explained.

The case follows the Supreme Court’s unanimous 2023 decision in Tyler v. Hennepin County, which ruled that governments cannot keep the surplus profit from tax foreclosures. However, the Pung case seeks to go further, arguing that "just compensation" must be based on the home's true value, not a low-ball auction price.

For Tia Pung, the loss wasn't just about money.

CLICK HERE FOR MORE COVERAGE OF MEDIA AND CULTURE

"The loss of our home had a deep financial, emotional, and mental impact," she said. "It took away the feeling of stability, peace of mind, and certainly our trust in local government."

She noted that the local community in their small town has been "outraged" by the situation.

Tia Pung says their family has received support and encouragement from their local community in their fight against Isabella County officials. (Pacific Legal Foundation)

"They, too, cannot understand how this could happen... they have shared prayers and words of support," she said.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Isabella County argues that the U.S. Supreme Court should reject Pung's "fair-market-value theory," asserting it has "no foothold in history or precedent."

The county maintains that "just compensation" under the Fifth Amendment is satisfied when the government returns the "surplus proceeds" realized from a public auction — the difference between the sale price and the tax debt — rather than a property's purported market value.

"As personal representative for the estate of his late nephew, Michael Pung had a duty to follow established Michigan law, file an affidavit and pay property taxes on the home in Isabella County," Matthew T. Nelson, a partner at Warner Norcross + Judd LLP and an attorney for Isabella County, told Fox News Digital. "He received repeated reminders of his obligation over the course of seven years. Mr. Pung had repeated opportunities to pay the property taxes, file an affidavit or file an appeal, yet he failed to take any of these steps."

Nelson noted the county returned a surplus of over $73,000 to Pung following the auction, but Pung still demanded fair market value.

"But that’s not how the law works," Nelson said. "Mr. Pung had ample time and opportunity to avoid this foreclosure and sale. He decided not to pay the taxes due on the property even when he knew that would mean his nephew’s family’s home would be foreclosed."

The Supreme Court is scheduled to hear oral arguments in Pung v. Isabella County on Feb. 25.

很赞哦!(5511)

相关文章

- 节能降耗“神器” 落地四座水厂 振动MBR行业应用加速!

- 荣耀与泡泡玛特联名潮玩手机正式发布

- 7 ภูมิปัญญาด้านสุขภาพจากทั่วโลกที่น่าลองนำมาใช้ในปีนี้

- 卡梅隆表示接下来两部《阿凡达》需要削减成本

- 全国首个虚拟偶像身份认证落地北京经开区

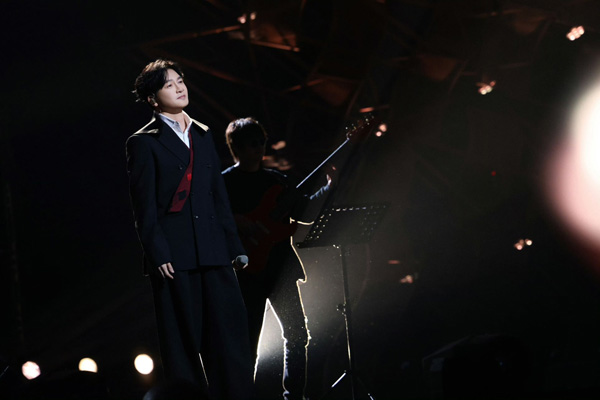

- 苏有朋《声生不息·华流季》热播 舞台风格鲜明被赞“好会唱”

- 森之国度手艺秘传器何时上线 手艺秘传器上线时间一览

- “中国好人”汪荣振:“这是我的赤诚之心”

- "องอาจ" นำทีม ปชป.ช่วยผู้สมัคร สส.ฝั่งธนฯ หาเสียงช่วงโค้งสุดท้ายก่อนเลือกตั้ง

- 特斯拉基本完成AI5芯片设计 已开始开发下一代AI6

热门文章

站长推荐

友情链接

- 漫染级浪漫!北京晚霞登场,随手一拍即屏保

- 0比0战平伊拉克队 U23国足首战抢到1分

- 光翼创新 CES 2026首发"可卷曲"光伏,引爆户外能源市场

- 读《索桥的故事》有感

- AI赋能高效研发:英矽智能携手海正药业,8个月完成临床前候选化合物提名

- 酷我音乐怎么关闭自动续费 自动续费关闭攻略

- 1月8日人民币对美元中间价报7.0197 下调10个基点

- 凯悦旗下全新品牌凯悦奕选(Unscripted by Hyatt)全球首秀,越南原创品牌 Wink 加入凯悦天地

- 伙伴弹途角色抽取优先级推荐攻略

- 伙伴弹途角色抽取优先级推荐攻略

- 灵璧县:“绣花功夫”精织基层治理“新画卷”

- 《海贼王》官方周边店开张首日混乱挤爆 官方致歉暂停售卖

- มนุษย์เป็นสิ่งมีชีวิตเดียวที่มี "น้ำตาแห่งอารมณ์"

- 中国U23男足激励下一代球员:替我们完成没有完成的梦想

- 首届亚洲智力运动大会落幕 中国队横扫象棋项目

- 从格斗擂台到现实应用:机器人“打”与“挨打”背后的技术锤炼

- 杭州智元研究院深耕养老产业 “踏山”外骨骼入选央企十大国之重器

- 平民食材也可以逆袭:猪横脷炖淮山

- 绯色回响角色强度排行榜2025一览

- 南陵县家发镇太白社区:禁放宣传全覆盖 文明安全入人心